Bitcoin (BTC) price rallied over 10% between April 9 and April 14, marking the highest daily close in more than ten months. While some analysts may argue the move justifies a degree of decoupling from traditional markets, both the S&P 500 and gold are near their highest levels in over six months.

Bitcoin price breaks $30,000 despite macro headwinds

Bitcoin’s gains and rally above $30,000 also happened while the dollar strength index (DYX), which measures the U.S. currency against a basket of foreign exchanges, reached its lowest level in 12 months.

The indicator fell to 100.8 on April 14 from 104.7 one month prior as investors priced in higher odds of further liquidity injections by the Federal Reserve.

Related: Bitcoin price teases $30K breakdown ahead of US CPI, FOMC minutes

The latest Federal Reserve’s monetary policy meeting minutes, released on April 12, made explicit reference to the anticipation of a “mild recession” later in 2023 due to the banking crisis. Even if inflation is no longer a primary concern, the monetary authority has little room to raise interest rates further without escalating an economic crisis.

Even if inflation is no longer a primary concern, the monetary authority has little room to raise interest rates further without escalating an economic crisis.

Strong macroeconomic data explains investors’ bullishness

While the global economy may deteriorate in the coming months, recent macroeconomic data has been mostly positive. For example, the European Union’s statistics office reported that industrial production in the 20 member countries increased 1.5% month on month in February, whereas economists polled by Reuters expected a 1.0% increase.

Furthermore, China’s latest macroeconomic data showed an encouraging trend, with exports increasing 14.8% year on year in March, snapping a five-month decline and surprising economists who expected a 7% decline. As a result, China’s trade balance for March was $89.2 billion, far exceeding the $39.2 billion market consensus.

The contrast between the current economic momentum and the forthcoming recession triggered by higher financing costs and a reduced appetite for risk among lenders causes Bitcoin investors to question the sustainability of the $30,000 support.

Let’s look at the Bitcoin derivatives metrics to better understand how professional traders are positioned in the current market environment.

BTC derivatives show no excessive leverage from longs

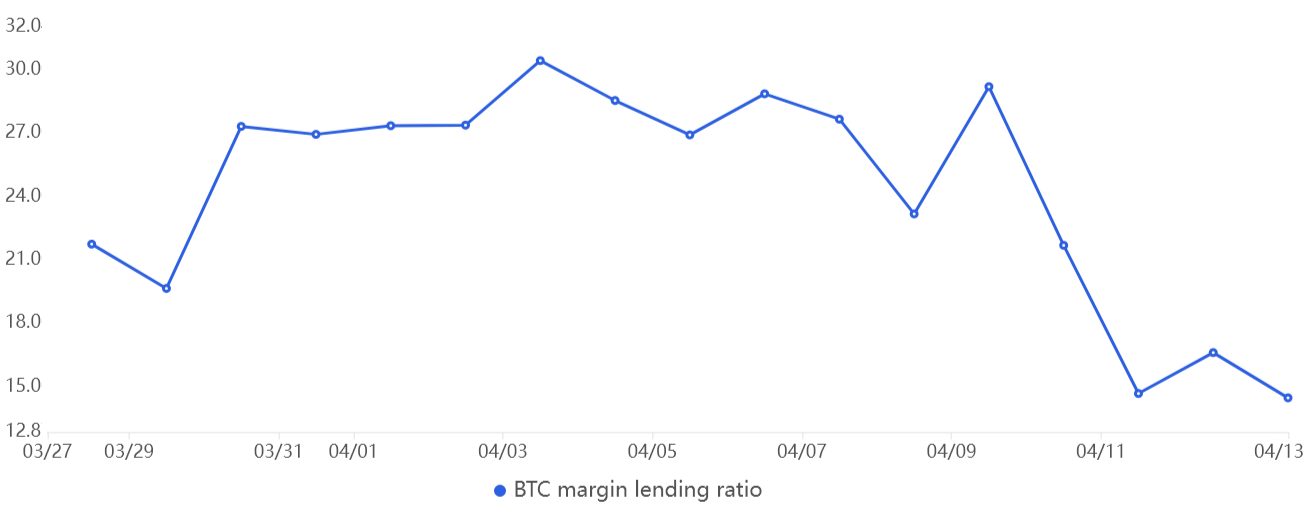

Margin markets provide insight into how professional traders are positioned because they allow investors to borrow cryptocurrency to leverage their positions.

OKX, for instance, provides a margin lending indicator based on the stablecoin/BTC ratio. Traders can increase exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only bet on the decline of a cryptocurrency’s price.

The above chart shows that OKX traders’ margin lending ratio decreased between April 9 and April 11. That is extremely healthy as it shows no leverage has been used to support Bitcoin’s price gains, at least not using margin markets. Moreover, given the general bullishness of crypto traders, the current margin lending ratio of 15 is relatively neutral.

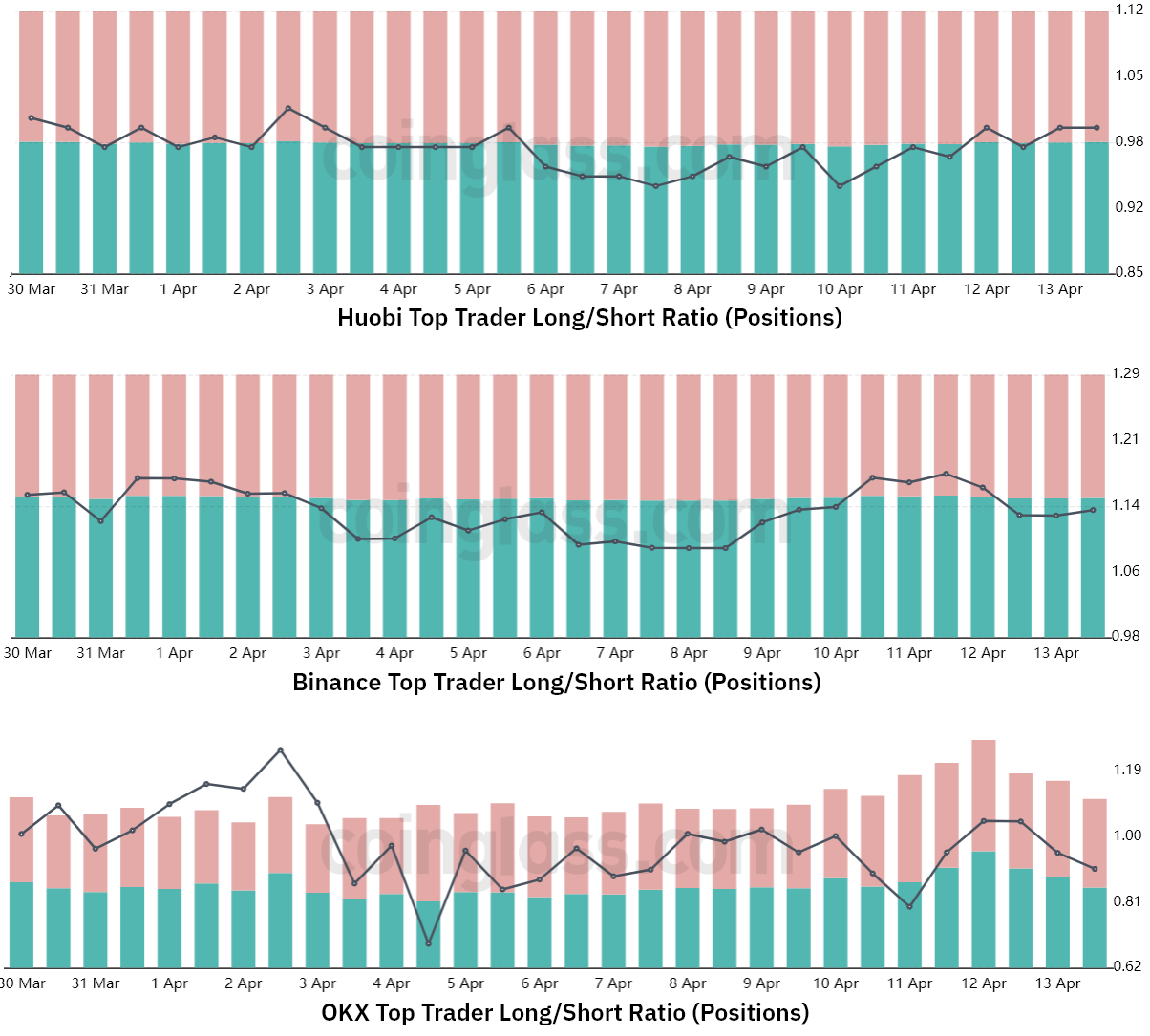

The long-to-short metric excludes externalities that might have solely impacted the margin markets. In addition, it gathers data from exchange clients’ positions on the spot, perpetual and quarterly futures contracts, thus offering better information on how professional traders are positioned.

There are occasional methodological discrepancies between different exchanges, so readers should monitor changes instead of absolute figures.

Interestingly, despite Bitcoin breaking $30,000 for the first time in 10 months, pro traders have kept their leverage long positions unchanged, according to the long-to-short indicator.

For instance, the ratio for Huobi traders stood firm near 0.98 from April 9 until April 14. Meanwhile, at crypto exchange Binance, the long-to-short slightly increased, favoring longs, moving from 1.12 on April 9 to the current 1.14. Lastly, at crypto exchange OKX, the long-to-short ratio slightly declined, from 1.00 on April 9 to the current 0.91.

Related: Tesla selling Bitcoin last year turned out to be a $500M mistake

Moreover, Bitcoin futures traders were not confident enough to add leveraged bullish positions. Thus, even if Bitcoin price retests $29,000 in terms of derivatives, bulls should be unconcerned because there has been little demand from short-sellers and no excessive leverage from buyers.

In other words, Bitcoin’s market structure is bullish, where BTC price can easily rally another 10% to $33,000 given sellers are currently scared to short it.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.