Bitcoin (BTC) staged another retest of $30,000 support on June 28 as the United States Federal Reserve stayed hawkish on inflation.

Powell on rate hikes: “More restriction coming”

Data from Cointelegraph Markets Pro and TradingView showed BTC price action sticking to a narrow range at the Wall Street open.

This accompanied fresh comments on economic policy from Fed Chair Jerome Powell.

Speaking during a two-day discussion with other central bank heads at the European Central Bank Forum on Central Banking 2023 in Sintra, Portugal, Powell reiterated Fed consensus for further interest rate hikes this year.

Having paused the hiking cycle, which began in late 2021, this month, Powell nonetheless stressed that there was still room for further policy tightening.

“Really, policy hasn’t been restricted for very long,” he said.

“We started at negative real interest rates; we’ve since moved up to where we are actually in restrictive territory, but we haven’t been there very long, so we believe there’s more restriction coming.”

Powell said that there was majority support for at least two further rate hikes going forward.

Bitcoin appeared hesitant as a result, retracing the prior day’s gains to shy away from a renewed attack on yearly highs at $31,000.

Reacting, market participants nonetheless chose to wait and see.

Still…sipping ☕️ and watching .#BTC #FireCharts pic.twitter.com/prTYNx3M6g

— Material Indicators (@MI_Algos) June 28, 2023

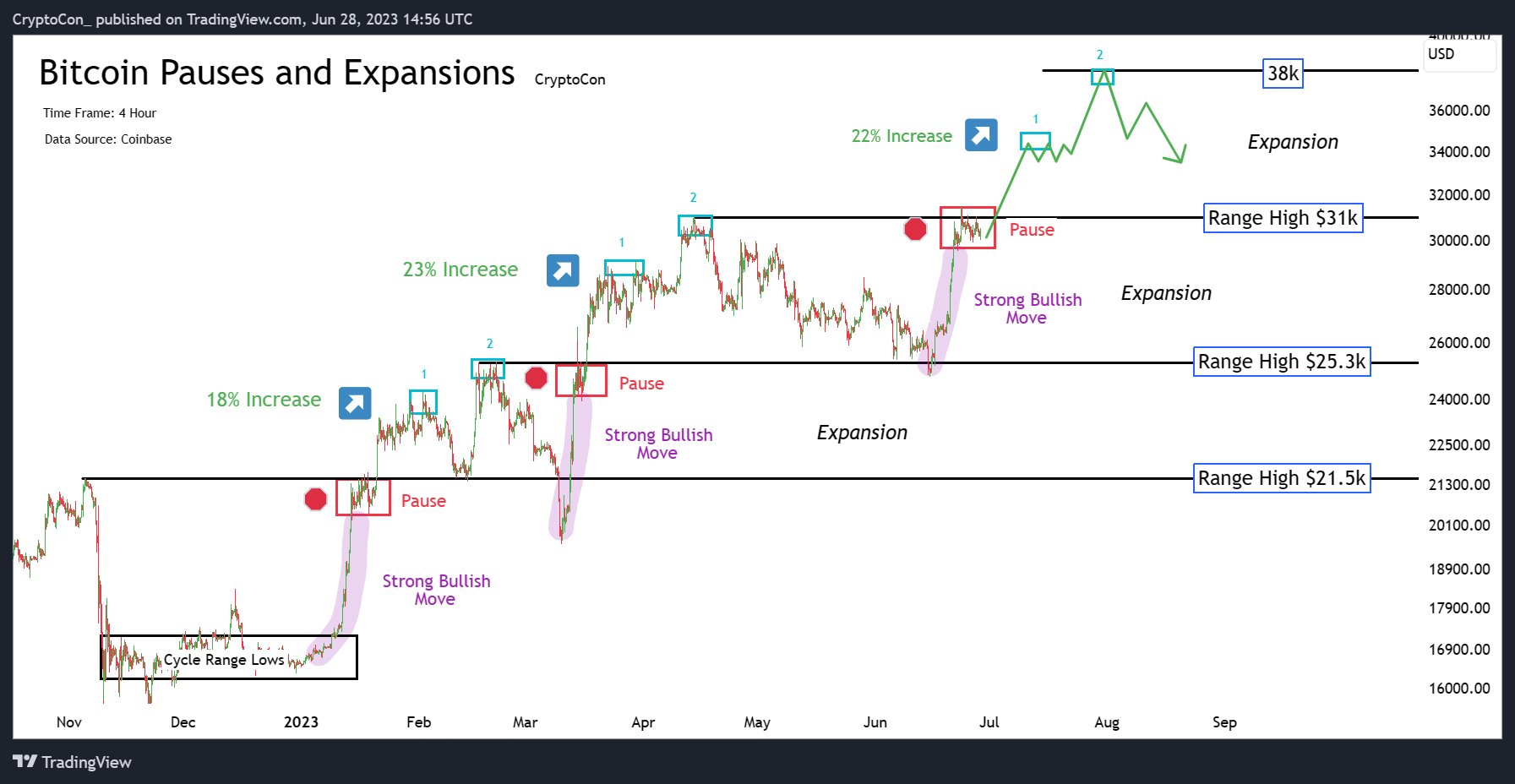

“Price bullishly explodes from the lows, takes a pause at the range high, and then continues to new yearly highs,” popular trader CryptoCon wrote in part of a tweet.

An accompanying chart demonstrated that BTC’s price was in familiar territory on its way up.

MicroStrategy Bitcoin dip-buying returns

News that MicroStrategy had purchased more than 12,000 BTC for its corporate treasury, meanwhile, failed to have a tangible impact.

Related: BTC price metric warns that Bitcoin speculators may sell past $33K

$BTC

lmao it appears the market doesn’t approve of saylor’s BTC purchase pic.twitter.com/86iP6qg9Do— Skew Δ (@52kskew) June 28, 2023

Confirmed by CEO Michael Saylor, the company announced that it had added 12,333 BTC — worth at the time $347 million — to its reserves, bringing its aggregate cost basis to $29,668 per BTC.

According to monitoring resource Bitcoin Treasuries, MicroStrategy now owns almost 0.7% of the entire potential BTC supply.

It also owns 10 times more than the second-largest treasury, belonging to Voyager Digital, which owns 12,260 BTC.

Magazine: How smart people invest in dumb memecoins: 3-point plan for success

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.