In a remarkable surge, Bitcoin has reached $43,499, marking a 0.71 percent increase on Tuesday. This notable ascent can be largely attributed to the burgeoning interest in Spot Bitcoin ETFs, which are poised to surpass the combined inflows of all 150 crypto ETPs currently in the market.

Adding to the positive momentum, Japan’s Cabinet has recently proposed a groundbreaking reform, aiming to eliminate the corporate tax on unrealized cryptocurrency gains. This move could significantly influence the global crypto landscape.

Meanwhile, in the United States, a Representative has highlighted a series of crypto bills that have been approved by the House Committee this year, signaling a growing legislative interest in the crypto sector. These developments collectively underscore a pivotal moment for Bitcoin and the broader cryptocurrency market.

Spot Bitcoin ETF Inflows Set to Eclipse 150 Crypto ETPs

The landscape of cryptocurrency investment is undergoing a seismic shift. Currently, the market boasts 150 crypto exchange-traded products (ETPs), amassing an impressive $50.3 billion in assets under management. This collection primarily includes funds tracking the titans of the crypto world, Bitcoin and Ethereum.

In a significant development, Grayscale’s Bitcoin Trust, the largest player in the ETP arena, is ambitiously vying to transform into a spot ETF.

The potential for spot Bitcoin ETFs to gain a foothold in the United States paints a promising picture, with expectations of surpassing the entirety of the current $50 billion crypto ETP market.

In just a few years, spot Bitcoin ETFs could be bigger than the entire $50 billion global crypto ETF market today. https://t.co/AZKuv8txlc

— Cointelegraph (@Cointelegraph) December 26, 2023

Analysts are casting bullish forecasts, envisioning a spectacular growth trajectory for these ETFs over the next five years. Projections range from a robust $2.4 billion to a staggering $72 billion in assets under management, underscoring the unbridled optimism in the sector.

This upswing, if it continues, could be a game-changer for Bitcoin prices, further fueled by the expanding involvement of institutional entities in the cryptocurrency market.

Japan’s Cabinet Aims to Abolish Tax on Unrealized Crypto Gains

In a landmark move, Japan’s Cabinet, under the leadership of Prime Minister Fumio Kishida, has passed a proposal to exempt corporation tax on unrealized gains from cryptocurrencies. This progressive step is aimed at catalyzing the growth of the nation’s burgeoning Web3 industry.

The proposed legislation, which is currently under deliberation in the Diet, seeks to abolish the corporate taxation on the difference between the market and book values of crypto assets, specifically those issued by external companies.

This legislative shift is poised to rectify a discrepancy in the tax treatment of third-party issued assets compared to those held by individuals. Presently, individuals are not subjected to tax on mark-to-market prices.

Japan to end taxation on unrealized mark-to-market gains of third-party-issued crypto assets it seeks to promote the development of Web3 in the country. @sheldonreback reports. https://t.co/NHo3FgQ0ok

— CoinDesk (@CoinDesk) December 25, 2023

If enacted, this reform would level the playing field, potentially spurring the growth of Web3 enterprises within Japan by lowering the fiscal barriers they currently face. This move is anticipated to not only retain existing Web3 businesses but also attract new ventures to Japan.

The Japanese government’s proactive stance underscores its commitment to nurturing the cryptocurrency sector as a pivotal element of its economic transformation strategy. This development could also positively influence Bitcoin prices, as it signals a conducive regulatory environment in a significant global market.

US Lawmaker Spotlights Crypto Legislation Passed by House Committee

Congressman Tom Emmer of Minnesota has spotlighted major achievements in crypto legislation for 2023, with significant progress made by the House Financial Services Committee. Notably, a provision now prevents the SEC from using taxpayer funds for crypto enforcement until Congress grants explicit jurisdiction.

This reflects the committee’s focus on promoting innovation in capital markets. Key legislative milestones include the Blockchain Regulatory Certainty Act and the Securities Clarity Act, which aim to lower barriers in the digital asset sector and clarify token classification.

Check out U.S. Congressman Tom Emmer’s recap of crypto bills approved by the House Financial Services Committee in 2023. The legislation aims to boost capital markets and hold regulators accountable. Read the full overview here: https://t.co/WCcOBfNahm

— Bony Bean (@bonybean) December 26, 2023

Additionally, the CBDC Anti-Surveillance State Act, passed in September, aims to curb government surveillance via digital currencies.

These developments, including the November appropriations amendment limiting the SEC’s enforcement reach, are poised to positively impact Bitcoin’s pricing by enhancing transparency and fostering industry growth.

Bitcoin Price Prediction

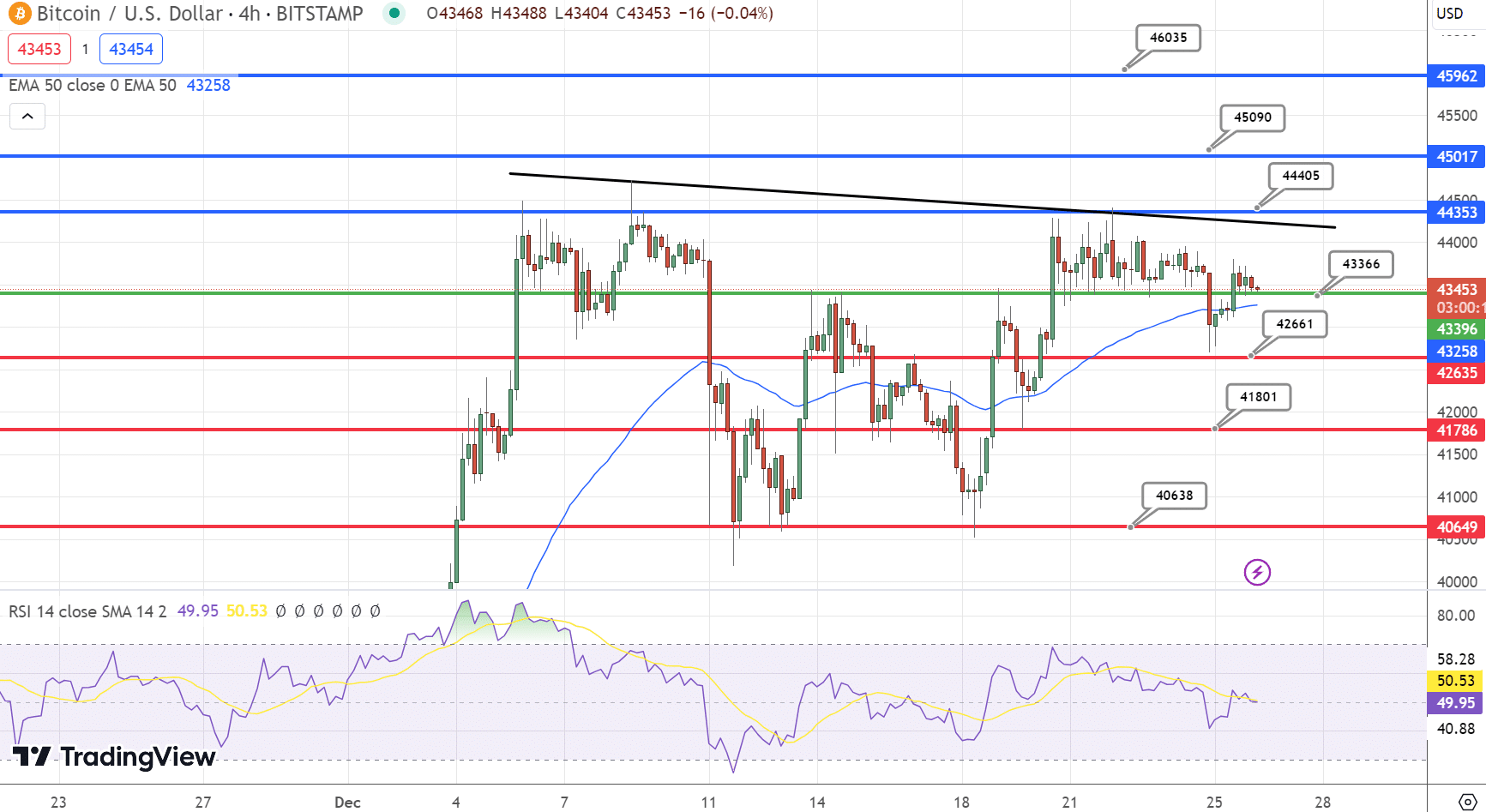

In today’s technical analysis of Bitcoin (BTC/USD) for December 26, the cryptocurrency is trading at $42,936, marking a 1.79% decline. Currently ranked highly in market cap, Bitcoin’s movements are crucial indicators for the broader crypto market.

The pivot point stands at $43,501, with immediate resistance observed at $44,393. Further resistance levels are at $45,045 and $45,975, while immediate support lies at $42,772, followed by $41,801 and $40,638.

📉 #BitcoinUpdate: BTC/USD dips to $42,936, down 1.79%. Eyeing pivotal resistance at $44,393, $45,045, $45,975 & support at $42,772, $41,801, $40,638. RSI at 40 signals bearishness. 📊 Below 50 EMA – watch for further downward trends. Stay alert traders! #CryptoAnalysis #BTC pic.twitter.com/VmEceWrGpe

— Arslan Ali (@forex_arslan) December 26, 2023

The Relative Strength Index (RSI) is at 40, suggesting bearish sentiment as it is below the 50 mark. The Moving Average Convergence Divergence (MACD) shows a value of -73 with a signal of -31, indicating potential downward momentum.

The 50-Day Exponential Moving Average (EMA) stands at $43,238. Bitcoin’s current price below the 50 EMA suggests a short-term bearish trend.

Chart patterns reveal that BTC has crossed below the 50 EMA line at the $43,238 mark, signaling that a bearish bias could dominate if it remains below this threshold.

The overall trend appears bearish below $43,238, and the short-term forecast indicates potential testing of lower support levels in the coming days. This analysis points to a cautious approach for traders, with a close watch on key resistance and support levels.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.