One hundred and eleven days have passed since Bitcoin (BTC) posted a close above $25,000 and this led some investors to feel less sure that the asset had found a confirmed bottom. At the moment, global financial markets remain uneasy due to the increased tension in Ukraine after this week’s Nord Stream gas pipeline incident.

The Bank of England’s emergency intervention in government bond markets on Sept. 28 also shed some light on how extremely fragile fund managers and financial institutions are right now. The movement marked a stark shift from the previous intention to tighten economies as inflationary pressures mounted.

Currently, the S&P 500 is on pace for a consecutive third negative quarter, a first since 2009. Additionally, Bank of America analysts downgraded Apple to neutral, due to the tech giant’s decision to scale back iPhone production due to “weaker consumer demand.” Lastly, according to Fortune, the real estate market has shown its first signs of reversion after housing prices decreased in 77% of United States metropolitan areas.

Let’s have a look at Bitcoin derivatives data to understand if the worsening global economy is having any impact on crypto investors.

Pro traders were not excited by the rally to $20,000

Retail traders usually avoid quarterly futures due to their price difference from spot markets, but they are professional traders’ preferred instruments because they prevent the fluctuation of funding rates that often occurs in a perpetual futures contract.

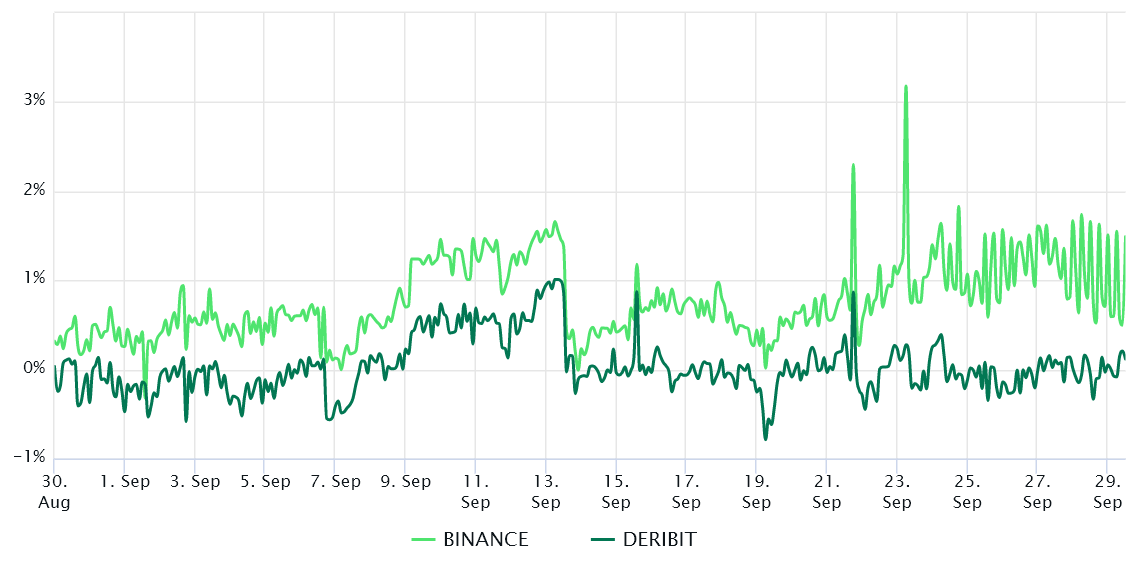

The three-month futures annualized premium, as seen in the chart above, should trade at +4% to +8% in healthy markets to cover costs and associated risks. The chart above shows that derivatives traders have been neutral to bearish for the past 30 days while the Bitcoin futures premium remained below 2% the entire time.

More importantly, the metric did not improve after BTC rallied 21% between Sept. 7 and 13, similar to the failed $20,000 resistance test on Sept. 27. The data basically reflects professional traders’ unwillingness to add leveraged long (bull) positions.

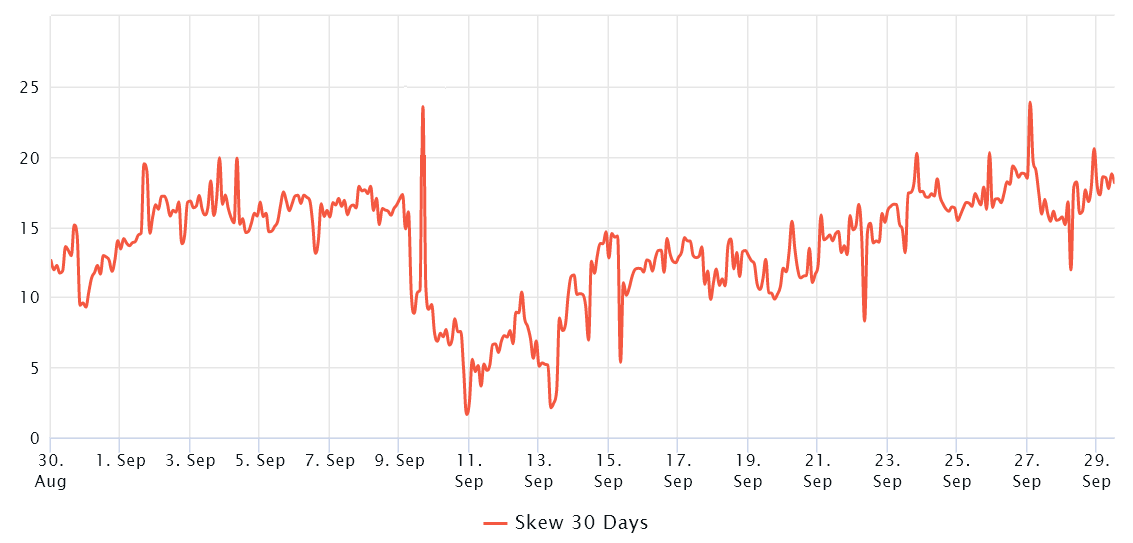

One must also analyze the Bitcoin options markets to exclude externalities specific to the futures instrument. For example, the 25% delta skew is a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 12%. On the other hand, bullish markets tend to drive the skew indicator below negative 12%, meaning the bearish put options are discounted.

The 30-day delta skew has been above the 12% threshold since Sept. 21 and it’s signaling that options traders were less inclined to offer downside protection. As a comparison, between Sept. 10 and 13, the associated risk was somewhat balanced, according to call (buy) and put (sell) options, indicating a neutral sentiment.

The small number of futures liquidations confirm traders’ lack of surprise

The futures and options metrics suggest that the Bitcoin price crash on Sept. 27 was more expected than not. This explains the low impact on liquidations. Despite the 9.2% correction from $20,300 to $18,500, a mere $22 million of futures contracts were forcefully liquidated. A similar price crash on Sept. 19 caused a total of $97 million in leverage futures liquidations.

From one side, there’s a positive attitude since the 111-day long bear market was not enough to instill bearishness in Bitcoin investors, according to the derivatives metrics. However, bears still have unused firepower, considering the futures premium stands near zero. Had traders been confident with a price decline, the indicator would have been in backwardation.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.