Tether (USDT) has emerged as a clear winner amid the ongoing banking crisis and crypto crackdown in the U.S.

On April 17, the U.S. dollar-pegged stablecoin’s circulating market valuation reached nearly $81 billion, just 1.5% below its record high of $82.29 billion from a year ago. It has grown about 20% year-to-date (YTD) already and is now eyeing new all-time highs.

Tether rivals hit new yearly lows

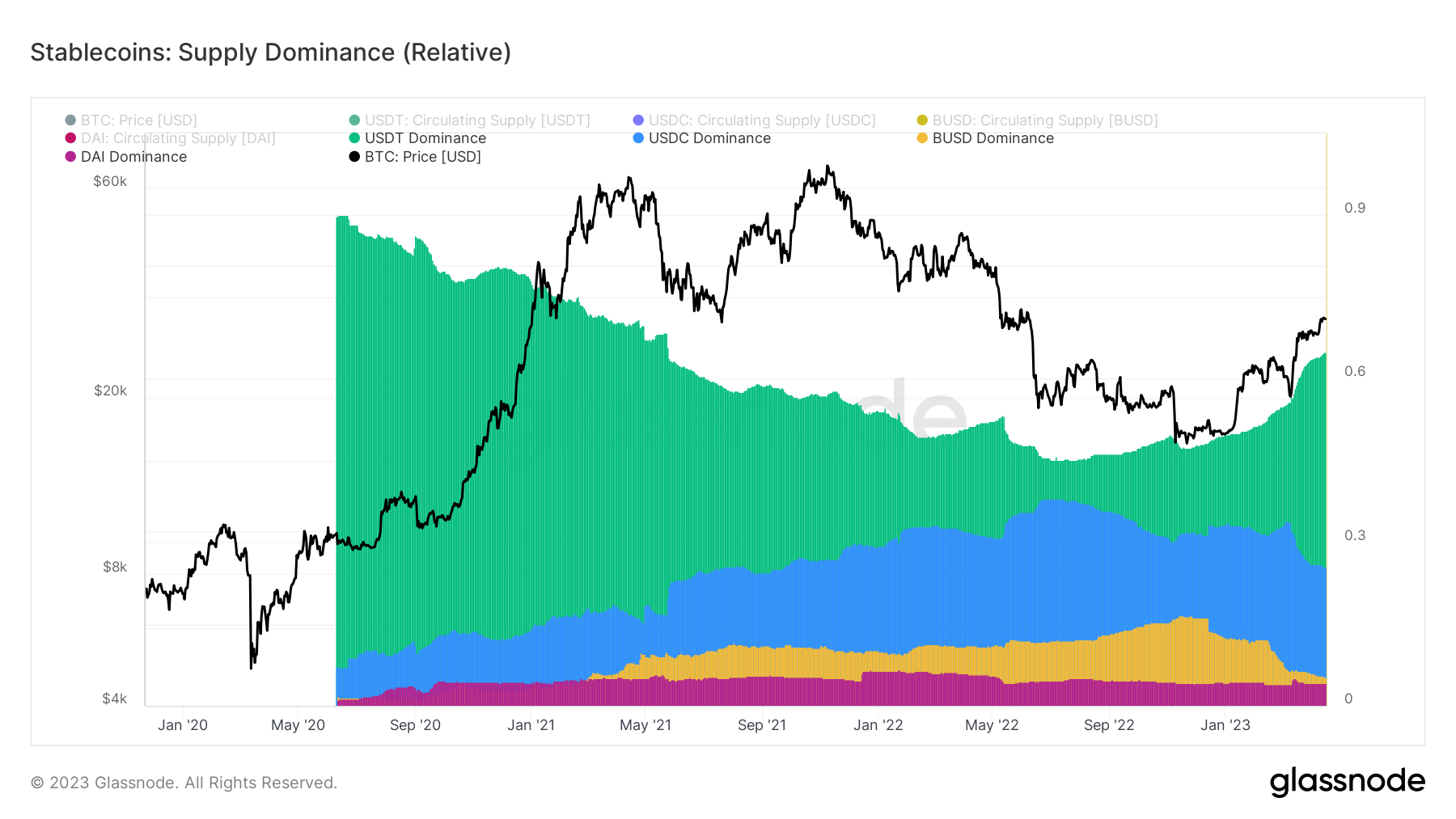

USDT’s growth came as Tether ate up the market share of its stablecoin rivals, USD Coin (USDC) and Binance USD (BUSD). That is due to crypto traders’ belief that Tether’s operations have no exposure to the potential banking crisis contagion.

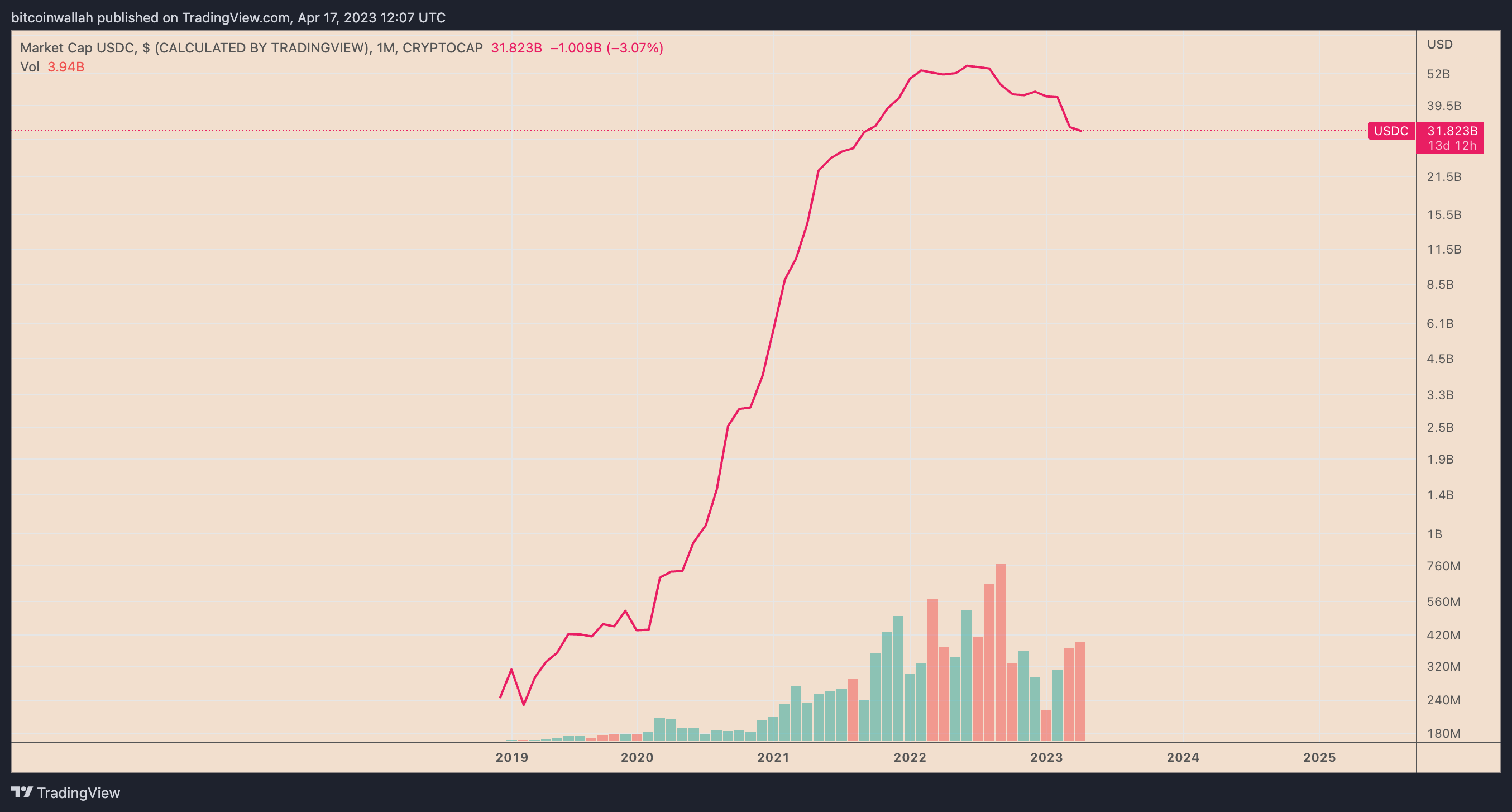

For instance, the circulating market capitalization of the USD Coin, the second-largest stablecoin, has dropped over 25% YTD to $31.82 billion, its worst since October 2021, primarily due to its exposure to the failed Silicon Valley Bank.

BUSD, on the other hand, has witnessed a 60% drop in market capitalization in 2023 to $6.68 billion, its lowest since April 2021, as the New York Department of Financial Services (NYDFS) ordered Paxos, a regional crypto firm, to stop its mint and issuance.

Moreover, the U.S. Securities and Exchange Commission (SEC) asserts that BUSD is a “security.” Conversely, the U.S. Commodity Futures Trading Commission (CFTC) alleges that the stablecoin is a “commodity.”

This capital shift likely helped Tether boost its dominance above 65% in the global stablecoin sector for the first time since May 2021, according to Glassnode data.

On April 16, the U.S. House Financial Services Committee published a draft version of its potential stablecoin bill to create definitions for issuers. It says that non-U.S. firms like Tether must register if they cater to Americans, albeit without mentioning the specific agency that would regulate stablecoins.

Exchange stablecoin supply lowest since June 2021

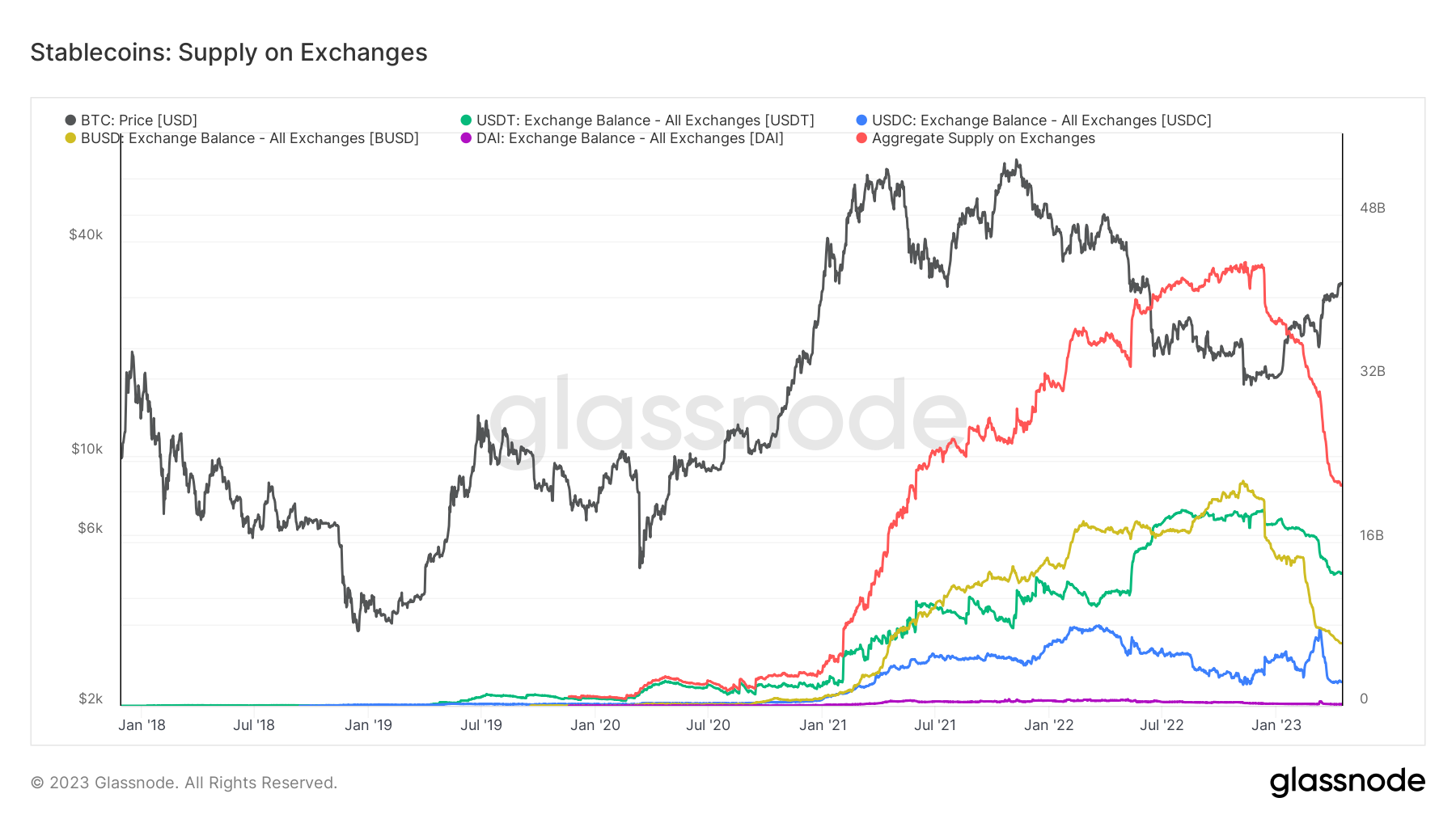

Despite Tether’s market capitalization growth, its supply across crypto exchanges has been declining in 2023.

Related: BTC price heading under $30K? 5 things to know in Bitcoin this week

As of April 16, cryptocurrency exchanges had 12.94 billion USDT in their reserves compared to 17.89 billion USDT at the year’s beginning. On the whole, the stablecoin supply across exchanges has dropped 42% YTD to $21.53 billion.

This dynamic coincides with the 21% YTD increase in the crypto market’s valuation from $1 trillion in January to $1.21 trillion, suggesting that Q1 has seen a trend shift from “safe” stablecoins to risk-on cryptocurrencies.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.