Can Bitcoin (BTC) sustain its bullish price momentum this week? Not for long according to James Check – lead on-chain analyst at Glassnode.

The leading cryptocurrency exploded to $44,400 on Tuesday, marking a new yearly high up 16.5% from 7 days prior. Yet despite his long-term optimism on the asset, Check said he’d be “surprised if Bitcoin didn’t consolidate / correct near term.”

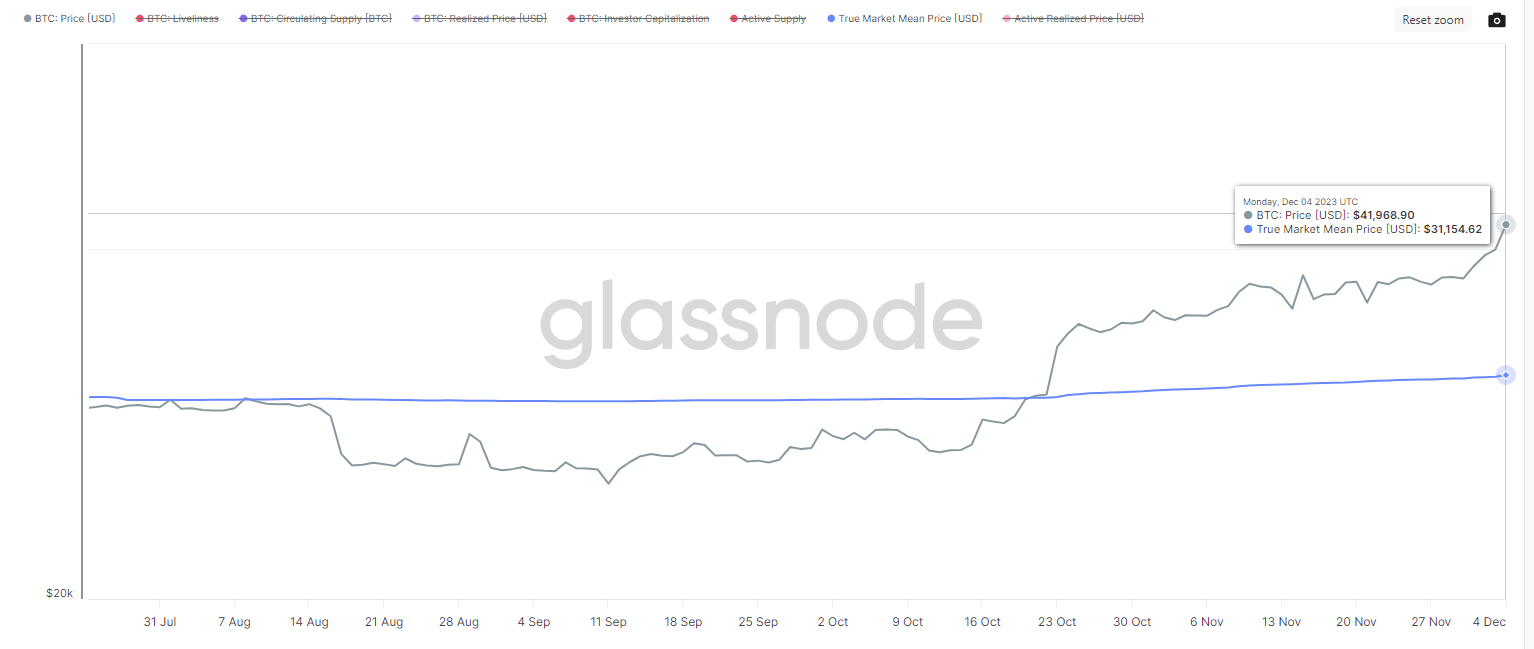

“A few months rest would allow investor cost bases to re-acclimate above the True Market Mean Price,” wrote the analyst in a post to X on Tuesday.

I’d be surprised if #Bitcoin didn’t consolidate / correct near term.

A few months rest would allow investor cost bases to re-acclimate above the True Market Mean Price.

Remarkably, the market hasn’t given back more than ~20% YTD, which suggests persistent and strong spot demand pic.twitter.com/2Ohjkuuwuq

— _Checkɱate 🔑⚡🌋☢️🛢️ (@_Checkmatey_) December 5, 2023

The True Market Mean Price is a Glassnode metric gauging the average price at which BTC investors have acquired their coins, based on blockchain data. On its website, the firm labels it “a likely reference point for mean reversion models.”

As of Monday, the mean price stood at $31,454, roughly 25% below the current exchange rate.

The exchange rate broke above the market mean starting on October 23, shortly after Israel’s conflict with Palestine began, and BlackRock CEO Larry Fink labelled Bitcoin a “flight to quality.”

Ever since, the asset has made steady gains amid ongoing negotiations between BlackRock and U.S. regulators over their Bitcoin spot ETF application, boosting investor confidence that an approval for the product is soon to come.

Before October, Bitcoin made relatively steady gains throughout the year between the March banking crisis and excitement over Ordinals NFTs. Unlike last year, the market hasn’t experienced any correction of more than 20% since 2023 began.

According to Check, a scenario in which BTC spikes consolidates between $35,000 and $50,000 until the halving is “very possible.” In the meantime, however, the price might spike to $55,000 on ETF excitement before retracing back to $42,000.

The Mining Outlook

Check noted that for every Bitcoin currently mined, roughly 2.5 coins are being removed from circulation into “hodler wallets.” He clarified:

“The supply dynamics absolutely favour the Bitcoin bulls. The hodlers demand higher prices for their [bitcoin] (as they should).”

The upcoming Bitcoin halving will theoretically double this ratio, as the number of daily BTC mined will be cut by 50%. Occurring once every four year, analysts widely see this as a catalyst for higher BTC prices.

It’s also a turning point for the BTC mining industry, which loses half of its revenue upon the halving taking place. This usually forces less efficient miners to capitulate while stronger miners remain and reap the rewards of BTC’s future appreciation.

Check estimates that the cost of BTC production for miners will be between $45,000 and $52,000 per coin after the halving.