The Bitcoin price is down today as cryptocurrency markets react to fresh FTX fallout and BTC bulls fail to defend already weak support.

Bitcoin (BTC) fell 5% in a single hour overnight into March 3, dropping to its lowest levels in over two weeks, data from Cointelegraph Markets Pro and TradingView shows.

The largest cryptocurrency joined Ether (ETH) and other major altcoins in a sharp comedown fueled mainly by concerns over Silvergate bank.

Analysts continue to see how the move will play out after BTC/USD preserved $22,000 as support. Some are calling for calm, while others believe that Bitcoin is still due a deeper retracement.

Cointelegraph takes a look at three major factors currently dictating crypto market trends.

Silvergate echoes FTX aftermath

The main talking point — and cause of pain for Bitcoin bulls — comes in the form of Silvergate bank.

Formally a banking partner for many of the crypto industry’s best-known names, these have begun reducing or abandoning their partnerships with Silvergate amid the possibility that it may be “less than well capitalized.”

Those words came from the bank itself, which in a filing to the United States Securities and Exchange Commission (SEC) this week delayed its annual 10-K report.

On the back of the move, U.S. exchange Coinbase announced that it had stopped using Silvergate, with Crypto.com then following suit.

Stablecoin giant Circle subsequently stated that it was “sensitive to the concerns around Silvergate” and was “in the process of unwinding certain services with them.”

Timeline of #Crypto Crash Today:

1. Coinbase suspends Silvergate payments

2. SEC says crypto exchanges not “safe”

3. Crypto․com suspends Silvergate payments

4. FTX confirms $8.9 billion in missing funds

5. Crypto loses $200+ million in hours

This can’t be a coincidence.

— The Kobeissi Letter (@KobeissiLetter) March 3, 2023

The episode marks the latest in the longrunning debacle which began with the bankruptcy of exchange FTX, to which many crypto firms had significant exposure.

With the shares of Silvergate parent company Silvergate Capital (SI) dropping almost 60% to all-time lows, Bitcoin nonetheless managed to avoid significant damage, commentators noted.

“Silvergate going down and exchanges losing their banking doesn’t impact Bitcoin,” Samson Mow, CEO of crypto tech provider Blockstream, reacted on Twitter.

“The collapse of fiat banking for exchanges will just mean buying/trading goes P2P. Just like in China. There’s still a robust P2P trading ecosystem with exchanges gone.”

A further post argued that “What’s happening to Silvergate now can happen to any bank.”

“Be your own bank,” Mow added.

BTC price already lacked support

For some traders, the leg down for Bitcoin was already a matter of time.

As Cointelegraph reported, BTC price action has spent weeks trying and failing to overcome resistance above $25,000, resulting in its most stagnant month on record.

With whale liquidity on exchanges also arguably contributing to the lack of organic price moves, a comedown came as little surprise.

If we fail to reclaim $23,750 tonight, we are going to dump it for CAPO And get these shorts moving pic.twitter.com/pyclL0rlaM

— Crypto Tony (@CryptoTony__) March 2, 2023

“There is our drop to ltf support as expected- now bulls have to make a stand here,” popuular trader Credible Crypto wrote in an update.

“If they fail to, then my downside target will be met sooner rather than later.”

An accompanying chart showed that target as lying around the $20,000 mark — a key psychological level originally reclaimed as support in January.

Margin call “smokes” crypto longs

Trading resource Skew meanwhile eyed one transaction in particular which it said caused the majority of the sharp downmove to multi-week lows on BTC/USD.

Related: 3 BTC price hurdles Bitcoin bulls are failing to clear in 2023

“BTC well no sharp squeeze up but sharp margin cascade here,” it revealed.

“What led this move is a large binance spot sale directly into an area of stacked up longs. Margin call.”

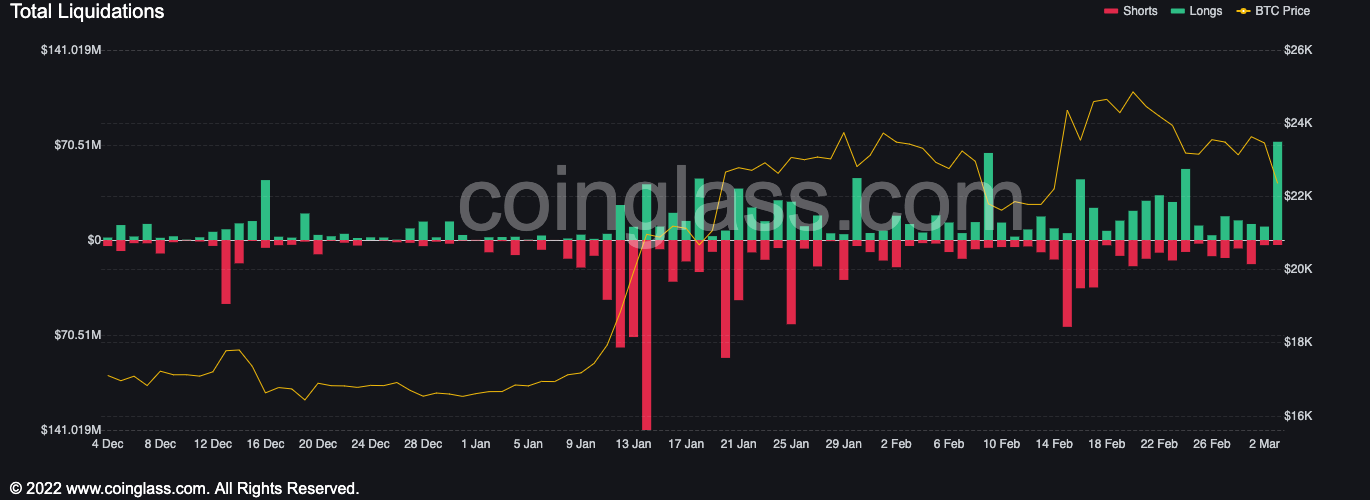

As a measure of how unprepared for a pullback the majority of traders were, long liquidations hit multi-month highs on March 3.

According to data from Coinglass, BTC long liquidations alone totaled $72.9 million at the time of writing. Cross-crypto liquidations stood at $205 million.

“Bybit longs got absolutely smoked, probably a short-term bottom here,” macro commentator Tedtalksmacro responded.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.