So you want to know about slippage? No, it’s not a medical disorder… it’s something that you need to know about if you’re trading crypto in the defi space. If you had purchased any token on the Ethereum network using metamask, you understand what slippage is. It’s a certain amount of coin that you’ll potentially lose during the transaction. Usually, .05 % may be up to 1%, and that’s pretty common on the Ethereum network. The problem with the Ethereum network currently and has been for a few years now has been the ever-growing fees that you have to pay per transaction when purchasing or selling a token. I have seen fees an average of $60 up to $250 per transaction, sometimes costing more than the purchase itself.

Binance Smart Chain – BSC

Another option is to use the Binance Smart Chain Network (BSC), which the fees to trade are a fraction of what you would be paying on the ethereum network. So the transactions are faster and cheaper, but the problem is slippage on the binance smart Chain Network varies drastically anywhere from half a percent, To where I’ve seen up to 18%. So to put that in perspective, if you invested in a coin months ago and it went up to say $10,000, and you want to cash it out, and on this coin, slippages set to 8% that means it would cost you around $800 the cell that coin. Not all the tokens on the BSC Network Have this high of slippage, but you have to be very careful on what projects you get involved with and know for sure what the slippage cost is buying and selling.

Be sure to do all your research on a project either with their white paper or Discussion Group and find out how much their slippage will cost you per transaction. Some projects factor in slippage to make money from every transaction, whether the price goes up or down. So with this in mind, you have to understand there are some projects out there that sole purpose of creation is to make money off of fees and have no practical purpose and may be built on hype. So if you’re a day trader looking to make games every day, you will have to be sure to factor in his slippage cost if you’re going to be investing in high-risk projects. Now that’s not saying every project out there has high slippage costs. Some have high liquidity, low fees, and low slippage, but these tend not to have the potential quick gains that high-risk projects do. So it’s pretty much Buyer beware.

If you are a veteran in crypto or just starting out, it’s always good practice to place test orders on the different networks to see how they work before you sink your life savings into a project that might gobble up all your money. Try to find a way to feel comfortable in knowing all the costs and risks involved.

Slippage on any network is something that you need to pay attention to because, in some cases, it’s variable. So you always want to set that manually instead of relying on a mechanism to do it automatically for you.

Where Do I Adjust Slippage?

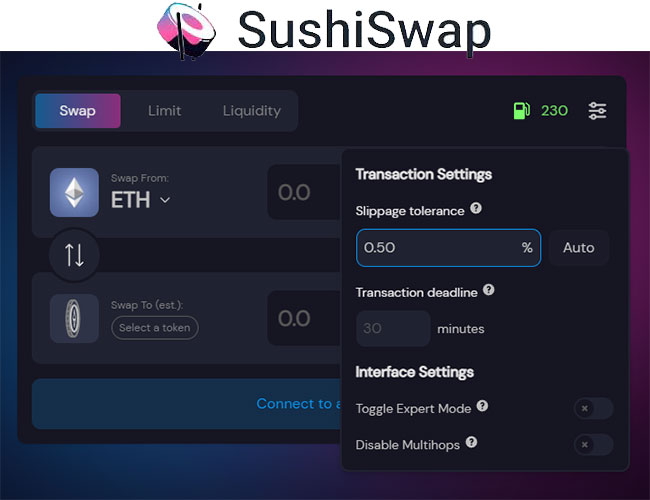

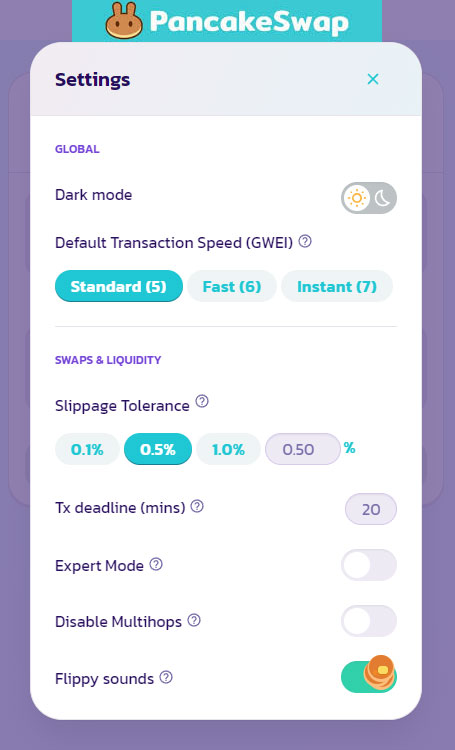

If You want to know where to adjust your slippage, it’s usually in the same place when you’re using a swapping mechanism on websites such as pancakeswap or alpaca. If you look at the top right corner of your swapping screen, you’ll see a tiny COG usually reserved for settings, and when you click it, you’ll see the slippage can be set there. So if you have tried to do a transaction and it has failed, you may need to increase your slippage. If you see an insufficient output amount, you usually deal with a prominent caution symbol, so it’s best to reject the order and try it again with an increased slippage amount. For example, the slippage amount needed to be another half a percent or percent more, so adjust the options but don’t just choose a high number because it’ll take that amount, and you may have spent more than you should.

Defy or Defi

A few Defi exchanges that you could trade on and learn more about this defi space is Sushi Swap and 1inch. ,and for BSC Networks and pancakesap and alpaca on the binance smart chain Network. As always, do not invest more than you’re willing to lose, and for God’s sake, do your research.

So is slippage good or bad? Well, that’s going to be up to you to decide if the benefits of paying high slippage are worth your investment risk. Sometimes it is, but that depends on the project and its growth potential. And keep in mind not all slippage is high. For example, if you were to swap your BNB token for Link, the slippage and the fees would be next to nothing.